If one is to answer the question about the possibilities of a tax rebate on personal loan the simple answer would be No. Is car loan interest tax-deductible.

New Business Vehicle Tax Deduction Buy Vs Lease Windes

When you file your taxes with the Internal Revenue Service IRS there are many rules about what can be deducted and how.

. Tax benefits on Car Loans. Contrarily the tax benefits that customers get to reap on home loans. However it is possible for taxpayers who meet certain criteria.

Personal loan taken for business purposes is also tax deductible. Repayment of interest on home loan is tax deductible under section 24 of income tax act of india. If its a loan for buying a commercial or residential property which is mortgaged to secure loan.

Maximum deduction allowed under Section 24 is Rs200000. You can only claim car loan tax benefits on the interest and not the principal amount. Article continues below advertisement.

Before borrowing against the home you should. Not only is the amount and tenure on these loans massive but also the loan installment that customers are required to pay are large sums of money. Even if you miss the deadline the government allows you to.

Thus as the interest on car loan is allowed to be treated as an expense this reduces the income tax. Based on your credit rating you can avail a car loan which finances up to 100 of the on-road price of the car. Car loans availed by self-employed individuals for vehicles that are used for commercial purposes are.

Principal loan amount is not tax deductible and do not offer any tax benefit. Is car loan interest tax deductible in india. The Income-tax Act of India has rules for tax deductions and exemptions on both the principal and interest of certain loans.

Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use. You can write off a part of your car loan interest if you bought a car for personal use but ALSO use it for business purposes. The dealer is prepared to sell the car on loan that is the entire cost of the car is to be repaid as loan in 12 installments at 145 per cent interest.

As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid. Section 24 of the Income Tax Act reduces the Income from house property by the amount of interest paid on home loan when the loan is taken for purchase renewal reconstruction repair or construction purposes. 10 Interest on Car Loan 10 of Rs.

The interest rates for the car loans in India start at as low as 665 pa. However salaried individuals should not wait till the last date and submit their returns before the deadline. The amount you can deduct will depend on how many miles you drive for business vs.

For regular taxpayers deducting car loan interest is not allowed. In Indian context if the loan is taken for business than you can claim interest paid on mortgage loan as deduction from business profits. These include home loans education loans business loans etc.

You can claim tax benefits only on interest. The interest paid on a business loan is usually deducted from the gross income. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of.

If deducting business expenses is new for you make sure to consult with. Home loans are one of the most hefty loan liabilities that customers in India avail. Car loans availed by individual customers do not offer any tax benefit.

08 February 2008 Respected members. Is car loan interest tax deductible in india. If a Salaried person takes a Car Loan then he cannot claim the Interest on Car Loan as an expense.

ITR filing last date. To claim car loan tax exemptions from Income Tax you need to show that you are using the car for legitimate business purposes and not as a personal vehicle. There are several lenders who offer car loans in India.

Is A Car Loan Interest Tax Deductible. The amount available as deduction for interest payout for self occupied property remains at Rs 15 lakhs and that of principal repayment is within the ceiling of section 80C ie. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible.

08 February 2008 If the car is used wholly and exclusively for business purpose then he can claim deduction. How to show home loan interest for self occupied house in. Using a home equity line will generally make the interest tax deductible.

Business loan interest amount is tax exempted. The interest paid on a business loan is usually deducted from the. Show you use the car for legitimate business purpose.

The interest charged on the loan. Car Loan Interest Rates 2022. However if you are buying a car for commercial use you can show the interest paid.

It is only allowed to be treated as an expense where the Car is being used for Business purposes. Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. The last date to file Income Tax Return is July 31 which is Sunday.

Sunday is a holiday which means that banks will be closed on that day for the public. Helps in the reduction of total tax amount to be paid. For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax.

My query is whether the interest to be paid to the dealer comes under deduction from taxable income or. Generally current law allows individual taxpayers to borrow up to 100000 of home equity and deduct the interest on that loan as home mortgage interest. This would also apply to the purchase of a vehicle or motor home.

When car loan interest is deductible. Answer 1 of 2. If youre an employee working for someone else you cant deduct auto loan interest expenses even if you use the car 100 for business purposes.

A person running a business can claim interest on car loan as deduction of Interest on car loan from his Profit computed under Profit or Gain from Business or Profession.

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Irs Fails To Stop Electric Car Tax Credit Cheats

Income Tax Rebates On New Cars Save Upto Rs 1 Lakh On Buying Car Youtube

You Can Get Tax Exemption Of Up To 1 5 Lakh On Electric Car Here S How

How Much Income Tax You Can Save On Buying An Electric Car Mint

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Buying An Electric Vehicle Know The Tax Benefit You Can Avail Electric Vehicles News

Germany S Vehicle Tax System Small Steps Towards Future Proof Incentives For Low Emission Vehicles International Council On Clean Transportation

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Accounting Bank Of India Partnership Accounting

How To Get A Tax Benefit For Buying A New Car Axis Bank

Every Thing About Car Loan Tax Benefit Paysense Blog

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Car Loan Tax Benefits And How To Claim It

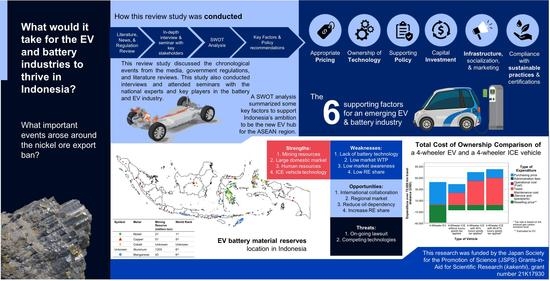

Batteries Free Full Text The Emerging Electric Vehicle And Battery Industry In Indonesia Actions Around The Nickel Ore Export Ban And A Swot Analysis Html